Buying a House: Delivery of the Property 2

Procedures for the Mortgage Tax Credit Program

f you purchase a house using a mortgage loan, you may be eligible for the mortgage tax reduction program (generally known as the “mortgage deduction”). However, there are certain conditions regarding the purchased home and loan that must be met in order to be eligible for the program, so be sure to check them carefully.

Point 1: System Overview and Tax Returns

If you use a mortgage loan to build or acquire a house (including the land acquired together with the house) or to make certain additions or renovations, a certain amount calculated based on the year-end loan balance will be deducted from your income tax and inhabitant tax. However, in order to receive the deduction, both company employees and self-employed persons must apply for the deduction on their tax returns.

For company employees, a tax return must be filed for the first year, but from the second year onward, a refund can be received through the year-end adjustment at the employer.

For company employees, a tax return must be filed for the first year, but from the second year onward, a refund can be received through the year-end adjustment at the employer.

Point 2: Mortgage Deduction Procedure Flow and Required

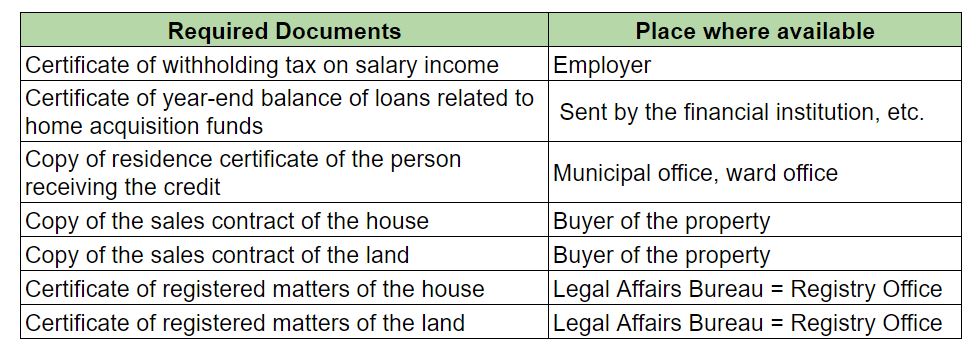

In order to receive the mortgage deduction, you must file an income tax return in the year following the year you move in and submit documents such as a withholding tax certificate (for company employees) and a copy of your residence certificate. In addition, a statement of calculation must be prepared when filing the return, so please obtain and confirm your tax return and other documents as soon as possible.

Documents required for mortgage deduction and where to obtain them