Buying a House: Housing Prices

Buying a House: Housing Prices

- No two properties are the same

No two properties are the same. Even land in the same area can vary greatly in price depending on the shape of the land, its area, direction, and the condition of the roads it borders. Also, even in condominiums in the same building, prices vary depending on the level of floors, layout, room direction, management status, and other factors. Thus, when judging the appropriateness of a real estate price, it is necessary to consider each property based on its characteristics (this is generally referred to as “individuality”).

- The timing of transaction changes prices

The real estate market also reflects overall market movements. Depending on the timing of transaction (this is generally referred to as the “point in time of transaction”), the price of the same real estate property may differ significantly. Therefore, when assessing real estate prices, it is necessary to take into account the overall market trends and consider them according to the time of transaction.

- Subject to the final agreement of the seller and buyer

Real estate transactions are not concluded by choosing “to buy or not to buy” for a given price, as when shopping at a grocery store. The price is fixed only when the seller and buyer individually adjust their desired conditions and reach an agreement.

* Since real estate prices are determined for each individual transaction, it is not possible to completely verify such prices with objective data alone. It is important to (1) gather as much information as possible (including advice from experts) and fully examine the price and (2) negotiate in good faith with the other party to the final transaction to ensure that you are satisfied with your own decision.

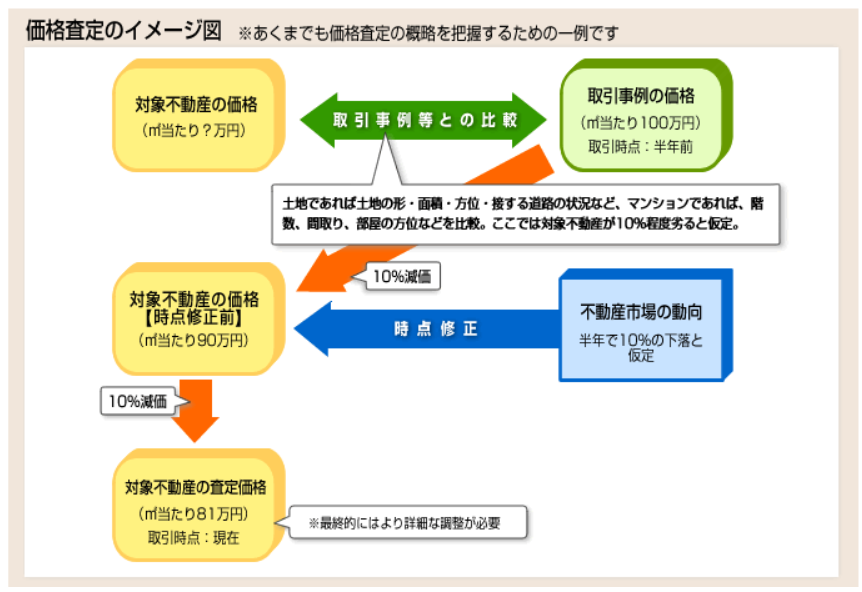

Land and condominiums are often assessed by the transaction comparison method, which is a method of assessing the price of subject real estate by comparing it with the price of transaction cases of similar real estate.

First, the subject property is compared with properties that serve as transaction examples, and the approximate price range of the subject property is assessed based on the prices of transaction examples. Then, certain adjustments are made for differences in transaction timing, taking into account trends in the overall market (this is generally referred to as “point-in-time correction”).

⇐ Trends in the real estate market (assuming a 10% decline in six months)

(810,000yen/㎡)

Time of transaction: Current

*More detailed final adjustments are needed.

For each item, the value of the property used as a transaction case for comparison is adjusted based on whether the subject property is better or worse, and the approximate value of the subject property is appraised. (For instance, if the subject property is deemed to be 10% inferior to the transaction example, the value of the transaction example is depreciated by 10%.)

- Selecting commercial land in a neighborhood as a transaction example for a property in a residential area

- Selecting a large plot of land in a residential area as a transaction example for an ordinary transaction in a residential area.

- Selecting a transaction of 10 years ago as a transaction example for residential land

- Selecting new condominiums as examples of existing (previously owned) condominium transactions

- Selecting studio condominiums as examples of family condominium transactions

- Selecting condominiums that are several decades old as examples of relatively new condominium transactions