Buying a House: the Budget 1

Buying a House: the Budget

Basic ideas of purchase costs

It is important to set an approximate budget before you begin the specifics of your property search. The following is an overview of the budget required to purchase a house and the concept of financial planning.

Point 1 Get a general idea of the budget needed to purchase a house.

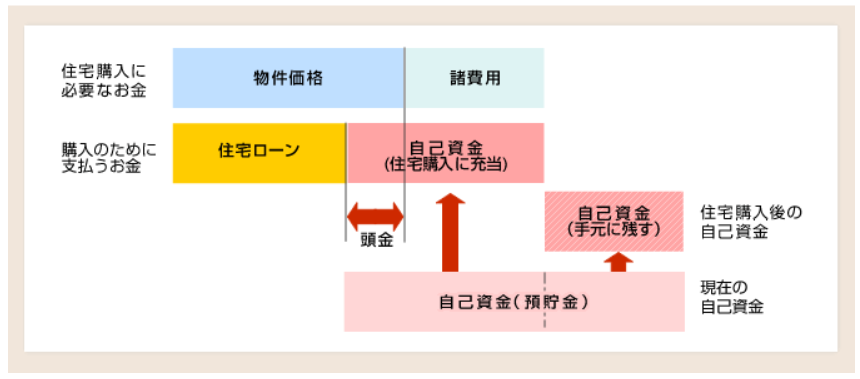

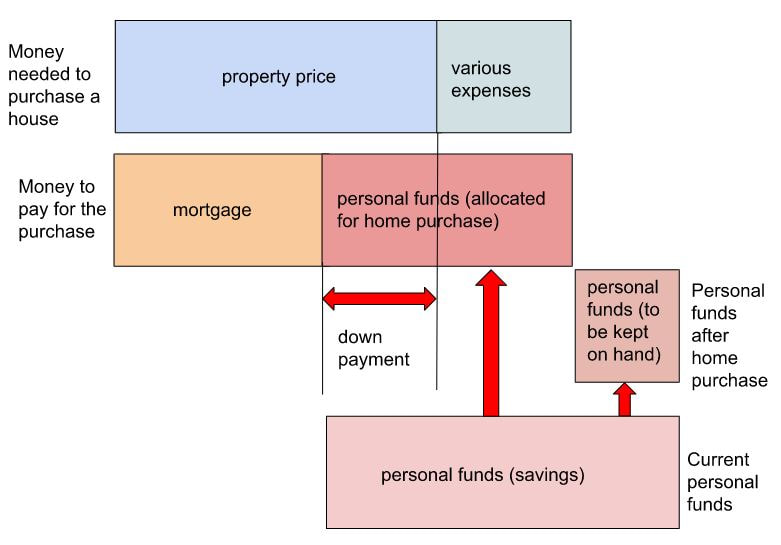

You cannot buy a house merely by securing funds equivalent to the purchase price of a property. Taxes, registration fees, mortgage expenses, moving expenses, and funds for purchasing furniture, appliances, and curtains are required. In addition, for newly built condominiums, a repair reserve fund of several hundred thousand yen is required in many cases at the time of purchase, and in the case of brokered properties, a brokerage fee is charged by the real estate company.

In other words, in order to purchase a house, it is necessary to prepare funds for the property price plus these various expenses. The necessary funds (property price + various expenses) for purchasing a house calculated as described above need to be prepared by self-financing or taking out a mortgage loan.

In other words, in order to purchase a house, it is necessary to prepare funds for the property price plus these various expenses. The necessary funds (property price + various expenses) for purchasing a house calculated as described above need to be prepared by self-financing or taking out a mortgage loan.

Property Price + Other Expenses = Own Funds + Mortgage Loan

If you are thinking of buying an existing house and remodeling it, you should also include the cost of remodeling in your estimate. Although most people pay for remodeling with their own funds, if you have taken out a mortgage to finance the purchase and can afford the repayments, you can also use the loan to pay for the remodeling costs.

Point 2 Know how much you can use from your personal funds for a down payment.

Now, let’s calculate the amount of your personal funds, such as savings, that can be used for a down payment on a home purchase. First, the amount to be allocated to the home purchase fund is determined by considering the amount of personal funds to be kept on hand, taking into account living expenses, education, and other expenses after the home purchase. Then, the down payment will be the amount obtained by subtracting the various expenses from the personal funds to be allocated for the house purchase.

Down payment = Total amount of personal funds – Current living expenses – Miscellaneous expenses for home purchase