Buying a House: the Budget 3

Buying a House: the Budget 3

Mak1ing a larger down payment

The larger your down payment is, the less you will borrow and the lower your loan repayment burden will be.

The lower your loan repayment burden, the more secure your household finances will be in the future, so consider ways to increase your down payment as much as possible.

The lower your loan repayment burden, the more secure your household finances will be in the future, so consider ways to increase your down payment as much as possible.

Point 1: Plan to increase your savings.

During the repayment period of a mortgage loan, there is a risk that household financial circumstances may change, such as an increase in children’s educational expenses or a decrease in income due to retirement, and you may be unable to pay the originally planned loan repayment amount.

However, if you can increase your down payment and lighten your repayment amount, you can reduce such risks. For this reason, it is important to plan ahead and save for the future.

However, if you can increase your down payment and lighten your repayment amount, you can reduce such risks. For this reason, it is important to plan ahead and save for the future.

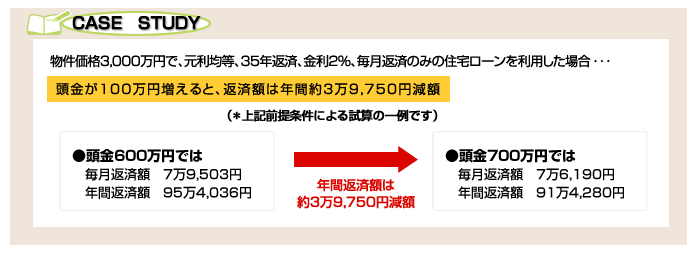

📖CASE STUDY

If a mortgage loan is taken out for a property price of 30 million yen, with equal principal and interest, 35-year repayment, 2% interest rate, and monthly repayment only…

If the down payment increases by 1 million yen, the annual repayment amount decreases by about 39,750 yen.

*This is an example of an estimate based on the above assumptions.

If the down payment increases by 1 million yen, the annual repayment amount decreases by about 39,750 yen.

*This is an example of an estimate based on the above assumptions.

|

With a down payment of

6 million yen Monthly repayment: 79,503 yen Annual repayment: 954,036 yen |

➡

The annual repayment amount is reduced by approx. 39,750 yen |

With a down payment of 7 million yen

Monthly repayment: 76,190 yen Annual repayment: 914,280 yen |

Point 2: Points to keep in mind when receiving financial assistance from your parents

You may be receiving financial assistance from your parents when purchasing a house. You can receive financial assistance by “borrowing from your parents” or “receiving a gift from your parents”.

When borrowing funds from your parents, it is important to note that in order for the loan to be recognized as a borrowing and not a gift, an IOU must be prepared and the interest rate, repayment method, and other conditions must be the same as those for a loan from a third party, even if the loan is from your parents.

It should also be noted that gifts received from your parents are subject to gift taxation, even if between you and your parents. However, there are cases where tax exemptions are available for gifts received from parents or grandparents, so please check in advance.

When borrowing funds from your parents, it is important to note that in order for the loan to be recognized as a borrowing and not a gift, an IOU must be prepared and the interest rate, repayment method, and other conditions must be the same as those for a loan from a third party, even if the loan is from your parents.

It should also be noted that gifts received from your parents are subject to gift taxation, even if between you and your parents. However, there are cases where tax exemptions are available for gifts received from parents or grandparents, so please check in advance.