Housing Taxes: Stamp Tax

Taxes When Buying a Home

When buying a house, you will have to pay stamp tax, consumption tax, registration and license tax, real estate acquisition tax, and other taxes.

Stamp Tax

Stamp tax is a tax that is imposed on contracts when a purchase agreement for the sale of a house or a mortgage contract is signed. The amount of tax is determined by the amount of money stated in the contract. In principle, the tax is paid by affixing revenue stamps to the contract and stamping a seal.

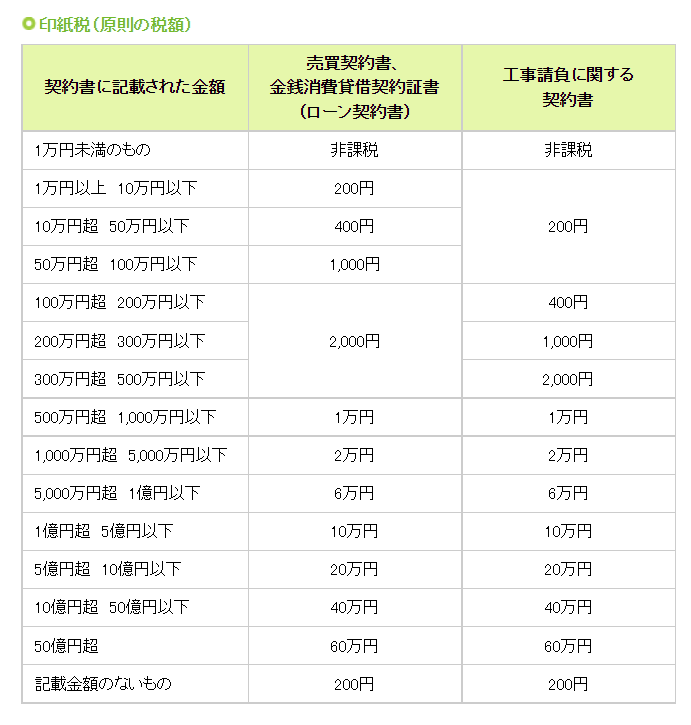

≪Stamp Tax ( general tax amount)≫

Sales Contracts and Loan Agreements

Sales Contracts and Loan Agreements

- The amount written in the contract < 10,000 yen —– tax exempt

- 10 ,000 yen < The amount written in the contract <= 100,000 yen —– 200 yen

- 100,000 yen < The amount written in the contract <= 500,000 yen —– 400 yen

- 500,000 yen < The amount written in the contract <= 1,000,000 yen —– 1,000 yen

- 1,000,000 yen < The amount written in the contract <= 5,000,000 yen —– 2,000 yen

- 5,000,000 yen < The amount written in the contract <= 10,000,000 yen —– 10,000 yen

- 10,000,000 yen < The amount written in the contract <= 50,000,000 yen —– 20,000 yen

- 50,000,000 yen < The amount written in the contract <= 100,000,000 yen —– 60,000 yen

- 100,000,000 yen < The amount written in the contract <= 500,000,000 yen —– 100,000 yen

- 500,000,000 yen < The amount written in the contract <= 1,000,000,000 yen —– 200,000 yen

- 1,000,000,000 yen < The amount written in the contract <= 5,000,000,000 yen —–400,000 yen

- 5,000,000,000 yen < The amount written in the contract —– 600,000 yen

- The amount not stated in the contract —– 200 yen

Construction Contracts

- The amount written in the contract < 10,000 yen —– tax exempt

- 10 ,000 yen < The amount written in the contract <= 1,000,000 yen —– 200 yen

- 1,000,000 yen < The amount written in the contract <= 2,000,000 yen —– 400 yen

- 2,000,000 yen < The amount written in the contract <= 3,000,000 yen —– 1,000 yen

- 3,000,000 yen < The amount written in the contract <= 5,000,000 yen —– 2,000 yen

- 5,000,000 yen < The amount written in the contract <= 10,000,000 yen —– 10,000 yen

- 10,000,000 yen < The amount written in the contract <= 50,000,000 yen —– 20,000 yen

- 50,000,000 yen < The amount written in the contract <= 100,000,000 yen —– 60,000 yen

- 100,000,000 yen < The amount written in the contract <= 500,000,000 yen —– 100,000 ye

- 500,000,000 yen < The amount written in the contract <= 1,000,000,000 yen —– 200,000 yen

- 1,000,000,000 yen < The amount written in the contract <= 5,000,000,000 yen —– 400,000 yen

- 5,000,000,000 yen < The amount written in the contract —– 600,000 yen

- The amount not stated in the contract —– 200 yen

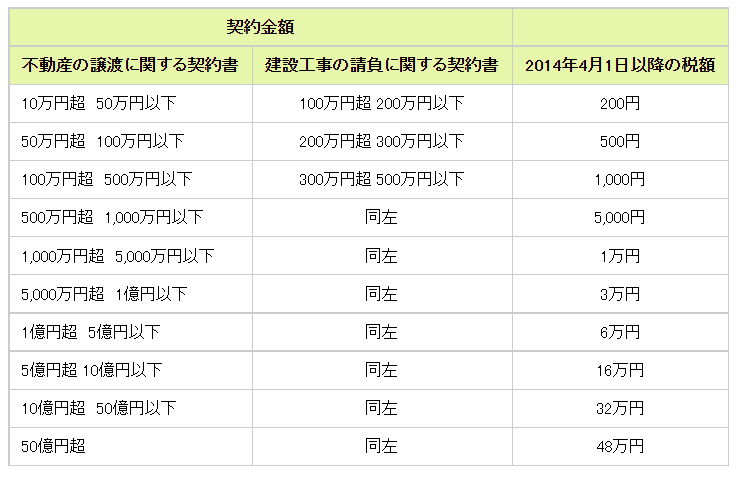

Tax Reduction for Home Acquisition

Stamp tax on sales contracts for the purchase of real estate such as houses and contracts for the construction of houses is reduced as follows from April 1, 2014 to March 31, 2024.

Real Estate Transfer Agreement

- 100,000 yen < The contract amount <= 500,000 yen —–200 yen

- 500,000 yen < The contract amount <= 1,000,000 yen —–500 yen

- 1,000,000 yen < The contract amount <= 5,000,000 yen —– 1,000 yen

- 5,000,000 yen < The contract amount <= 10,000,000 yen —– 5,000 yen

- 10,000,000 yen < The contract amount <= 50,000,000 yen —– 10,000 yen

- 50,000,000 yen < The contract amount <= 100,000,000 yen —– 30,000 yen

- 100,000,000 yen < The contract amount <= 500,000,000 yen —– 60,000 yen

- 500,000,000 yen < The contract amount <= 1,000,000,000 yen —– 160,000 yen

- 1,000,000,000 yen < The contract amount <= 5,000,000,000 yen —– 320,000 yen

- 5,000,000,000 yen < The contract amount —– 480,000 yen

Construction Contract Agreement

- 1,000,000 yen < The contract amount <= 2,000,000 yen —–200 yen

- 2,000,000 yen < The contract amount <= 3,000,000 yen —–500 yen

- 3,000,000 yen < The contract amount <= 5,000,000 yen —– 1,000 yen

- 5,000,000 yen < The contract amount <= 10,000,000 yen —– 5,000 yen

- 10,000,000 yen < The contract amount <= 50,000,000 yen —– 10,000 yen

- 50,000,000 yen < The contract amount <= 100,000,000 yen —– 30,000 yen

- 100,000,000 yen < The contract amount <= 500,000,000 yen —– 60,000 yen

- 500,000,000 yen < The contract amount <= 1,000,000,000 yen —– 160,000 yen

- 1,000,000,000 yen < The contract amount <= 5,000,000,000 yen —– 320,000 yen

- 5,000,000,000 yen < The contract amount —– 480,000 yen

*Only sales contracts for the purchase of real estate and contracts for the construction of housing are eligible for the reduction.