Housing Taxes: Registration and License Tax

Registration and License Tax

- Tax amount (for land and buildings) = assessed taxable value of fixed property (tax base*) x designated tax rate

- Tax amount (for mortgages) = amount of claim (tax base*) x designated tax rate

*The tax base is the amount or quantity directly subject to tax calculation.

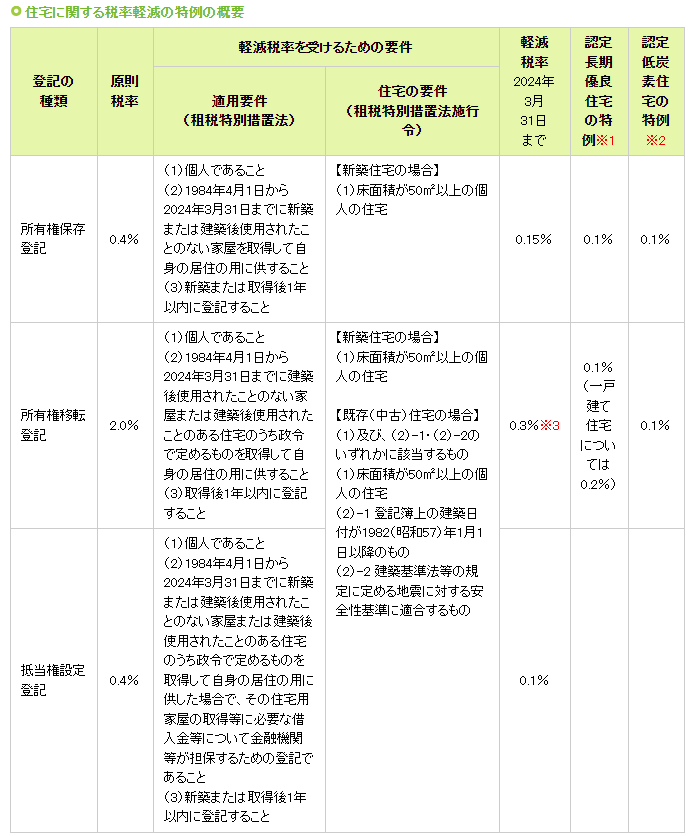

Further special measures are available for Certified Long-term Quality Housing*1 and Certified Low Carbon Housing*2.

*1 Long-term quality housing certified under the provisions of the Act on Promoting the Development of Long-Term Quality Housing, hereinafter referred to as “Certified Long-Term Quality Housing.

*2 Low-carbon housing certified in accordance with the provisions of the Act Concerning the Promotion of Low Carbon Emission in Urban Areas, hereinafter referred to as “Certified Low Carbon Housing”. It includes housing that is a specified building to be developed through a certified intensive urban development project that is deemed to be a certified low-carbon housing.

1. Registration of preservation of ownership ・・・ 0.4% (Basic tax rate)

- Requirements to qualify for the reduced tax rate

Eligibility Requirements (Special Taxation Measures Law)

(1) Be private individuals.

(2) Acquire between April 1, 1984 and March 31, 2024 a newly built house or a house that has not been used since its construction and use it for one’s own residence.

(3) Register it within a year of construction or acquisition.

Housing Requirements (Special Taxation Measures Law Enforcement Order)

In the case of a newly built house:

(1) Private housing with a floor area of 50㎡ or more

- Reduced tax rate until March 31, 2024 ・・・ 0.15%

- Special Exception for Certified Long-Term Quality Housing*1 ・・・ 0.1%

- Special Exception for Certified Low Carbon Housing*2 ・・・ 0.1%

2. Registration of transfer of ownership ・・・ 2.0% (Basic tax rate)

- Requirements to qualify for the reduced tax rate

Eligibility Requirements (Special Taxation Measures Law)

(1) Be private individuals.

(2) Acquire between April 1, 1984 and March 31, 2024 a house that has not been used since its construction or a house that has been used since its construction -which is specified by a Cabinet Order – and has been used for one’s own residence.

(3) Register it within a year of acquisition.

Housing Requirements (Special Taxation Measures Law Enforcement Order)

In the case of a newly built house:

(1) Private housing with a floor area of 50㎡ or more

In the case of an existing (used) house:

When either (1), (2)-1, or (2)-2 below applies, the tax rate will be reduced.

(1) Individual residences with a floor area of 50 ㎡or more

(2)-1 Those whose construction date on the registry is January 1, 1982 or later.

(2)-2 Those that comply with the earthquake safety standards stipulated in the Building Standard Law and other regulations.

- Reduced tax rate until March 31, 2024 ・・・ 0.3% *3

- Special Exception for Certified Long-Term Quality Housing ・・・ 0.1% (a detached house: 0.2%)

- Special Exception for Certified Low Carbon Housing ・・・ 0.1%

3. Registration of mortgage ・・・ 0.4% (Basic tax rate)

- Requirements to qualify for the reduced tax rate

Eligibility Requirements (Special Taxation Measures Law)

(1) Be private individuals.

(2) Acquire between April 1, 1984 and March 31, 2024 a newly built house, a house that has never been used since its construction, or a house that has been used since its construction – which is specified by a Cabinet Order – and has been used for one’s own residence as specified by a Cabinet Order, and the registration is for the purpose of securing loans necessary for the acquisition of the residential house from a financial institution.

(3) Register it within a year of construction or acquisition.

Housing Requirements (Special Taxation Measures Law Enforcement Order)

In the case of a newly built house:

(1) Private housing with a floor area of 50㎡ or more

- Reduced tax rate until March 31, 2024 ・・・ 0.15%

- Special Exception for Certified Long-Term Quality Housing*1 ・・・ 0.1%

- Special Exception for Certified Low Carbon Housing*2 ・・・ 0.1%

In the case of an existing (used) house:

When either (1), (2)-1, or (2)-2 below applies, the tax rate will be reduced.

(1) Individual residences with a floor area of 50 ㎡or more

(2)-1 Those whose construction date on the registry is January 1, 1982 or later.

(2)-2 Those that comply with the earthquake safety standards stipulated in the Building Standard Law and other regulations.

- Reduced tax rate until March 31, 2024 ・・・ 0.1%

*1*2 The special provisions for Certified Long-term Quality Housing and Certified Low Carbon Housing are applicable when a private individual builds a new Certified Long-term Quality Housing or Certified Low Carbon Housing within a certain period or acquires one that has never been used after construction, uses it for the individual’s residence, and registers the preservation of ownership or the transfer of ownership within a year of acquisition.

*3 If a private individual acquires an existing residential building for which certain additions, alterations, etc. have been made by a real estate agent between April 1, 2014 and March 31, 2024, the tax rate for the registration of ownership transfer of the residential building will be reduced to 0.1% when the registration is made within a year of acquisition.

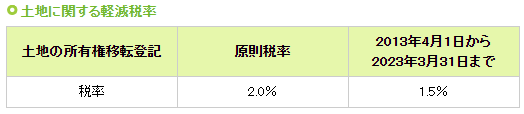

Basic tax rate ・・・ 2.0%

From April 1, 2013 to March 31, 2023 ・・・ 1.5%